Underwrite deals in

15 minutes, not 4 hours

Run 20,000 scenarios. Model waterfalls. Generate investor-ready reports. All before your competition opens Excel.

Run 20,000 scenarios. Model waterfalls. Generate investor-ready reports. All before your competition opens Excel.

Trusted by investors analyzing

Every new deal means rebuilding your Excel model from scratch. By the time you finish, the deal is under contract with someone else.

Your base case shows 18% IRR. But what if rent growth is 1% lower? Without running thousands of scenarios, you're just guessing.

You copy a row and suddenly your IRR is off by 300bps. These errors hide and surface at the worst possible moment.

Enterprise software costs $15,000+/year per seat. You shouldn't need a six-figure budget to analyze deals professionally.

Pro Forma AI solves all of this.

What used to take an analyst 4+ hours now takes 15 minutes — with better accuracy and deeper insights.

Real estate investors waste thousands of hours building Excel models from scratch. They make mistakes. They miss deals. And when they finally get an analysis done, it's based on a single set of assumptions — hope, not data.

Enterprise tools like ARGUS cost $15,000+/year and require weeks of training. Most investors simply go without institutional-quality analysis.

Pro Forma AI is like having a senior acquisitions analyst on your team — available 24/7, never makes calculation errors, and runs 20,000 scenarios before you finish your coffee.

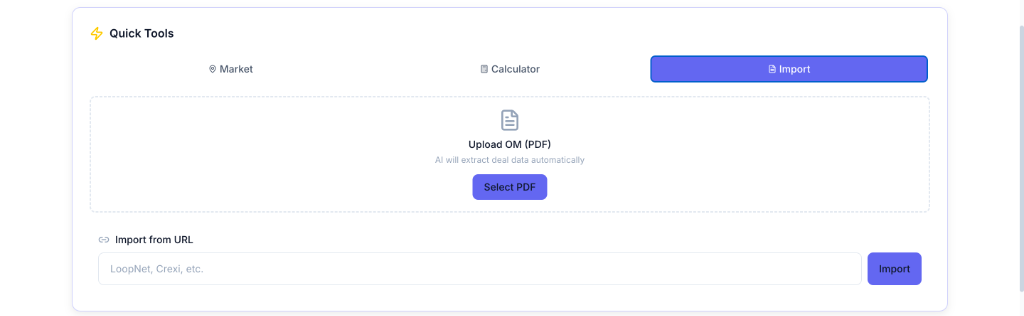

Enter the basics: purchase price, rent, expenses, debt terms, and waterfall structure. Or upload an OM and let AI fill it for you.

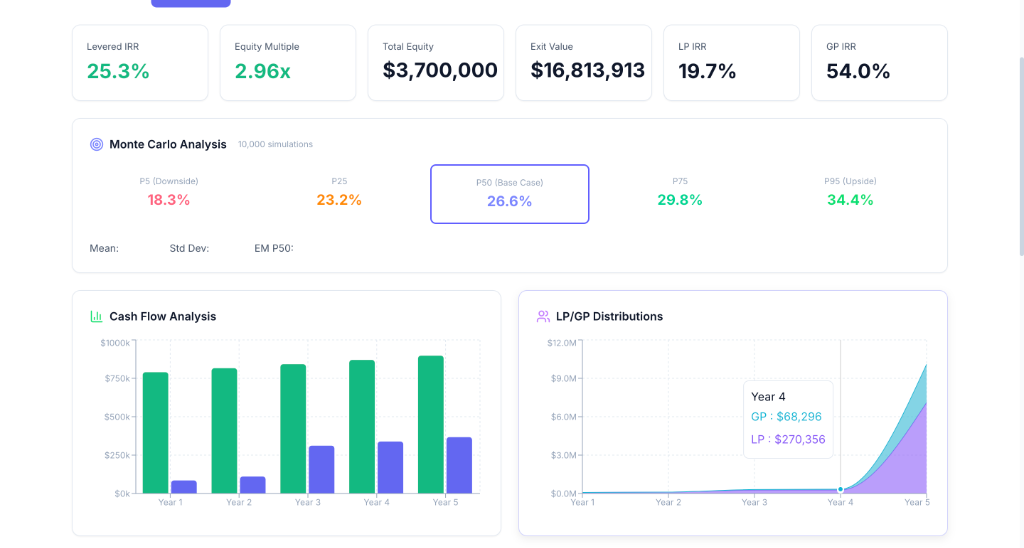

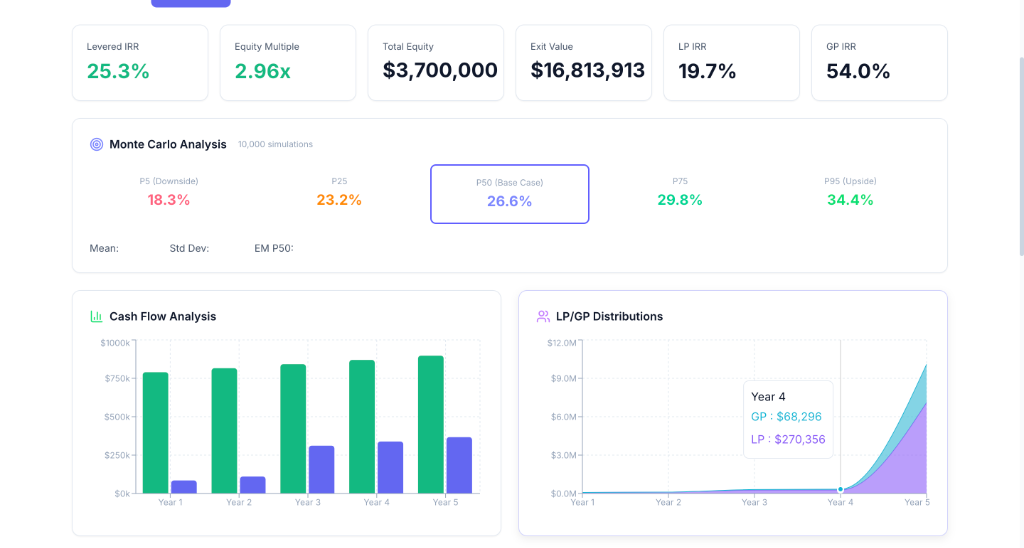

Click once. In seconds, you'll see full cash flows, Monte Carlo distributions, sensitivity tables, and LP/GP returns.

Download beautiful PDF reports with your logo, or export to Excel for further modeling. Ready for your IC memo or LP deck.

Professional-grade underwriting without the enterprise price tag

Run 20,000 scenarios to understand your probability of hitting target returns.

Full promote tiers, pref, catch-up, and residual splits.

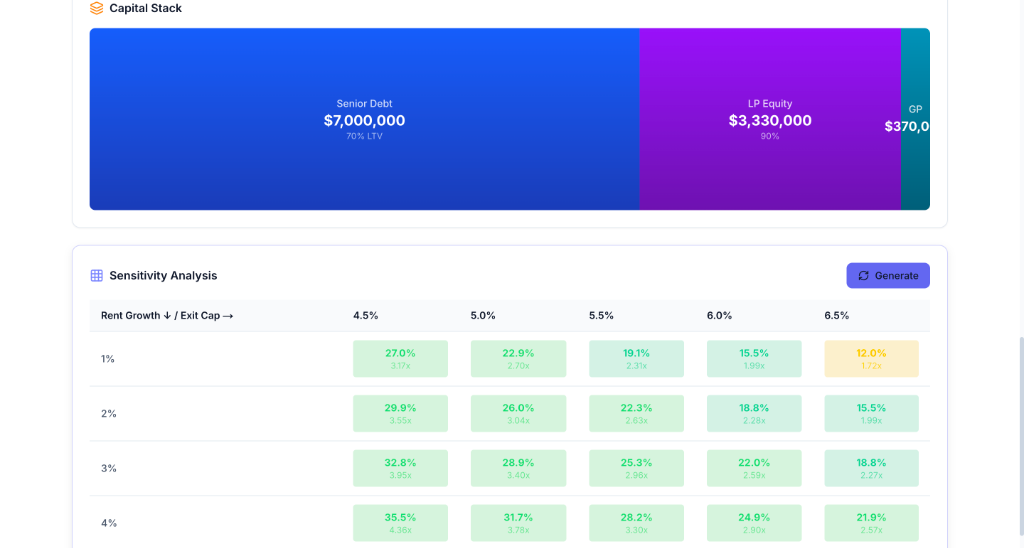

Interactive heatmaps for rent growth vs exit cap scenarios.

Institutional-quality exports with your branding

Full model data for further analysis

Access from any device, anywhere

Upload an Offering Memorandum PDF and our AI extracts all the key data automatically.

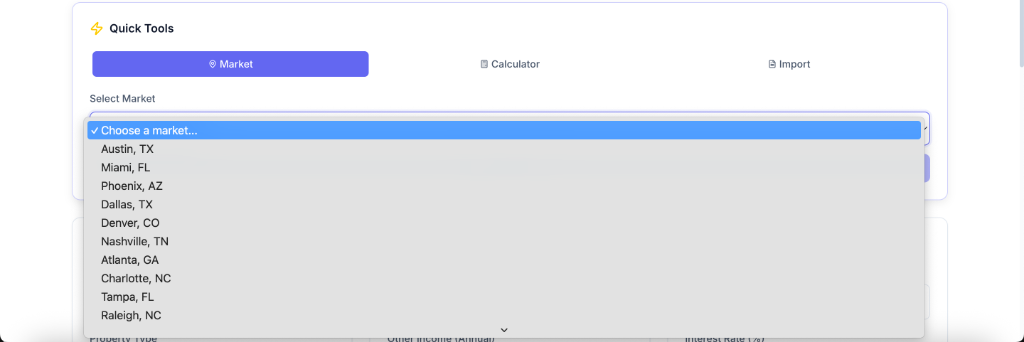

Pre-filled defaults for Austin, Miami, Dallas, Denver & more.

Paste LoopNet or Crexi URL to auto-fill deal data

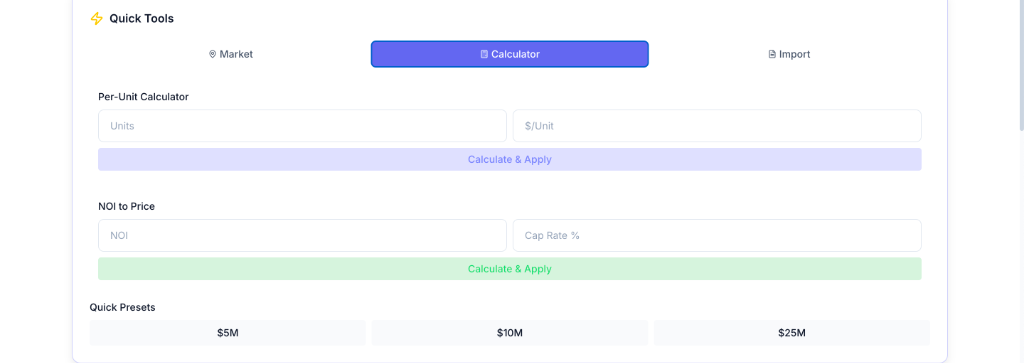

Per-unit pricing, NOI→Price, and quick presets for fast analysis.

Model unit renovations with per-unit costs, monthly rent bumps, and phased timelines.

Property tax, management fee %, reserves per unit

Analyze lot sales and residential land development with absorption schedules and sellout timelines.

| Feature | Excel | ARGUS | Pro Forma AI |

|---|---|---|---|

| Annual Cost | ~$400 | $5,000-15,000 | $1,000/yr |

| Build a pro forma | 4-6 hours | 1-2 hours | 15 minutes |

| Monte Carlo simulations | ❌ Not available | ❌ Not available | ✅ 20,000 scenarios |

| LP/GP Waterfall | Manual | Basic | ✅ Full promote tiers |

| Sensitivity analysis | Data tables only | Scenario manager | ✅ Interactive + Monte Carlo |

| Learning curve | Moderate | Steep (certification) | ✅ Instant |

| Cloud-based | ❌ Desktop | ⚠️ ARGUS Cloud extra | ✅ Included |

| Seats included | 1 (per license) | 💰 Per-seat pricing | ✅ 2-5 (10 on Lifetime) |

| Setup time | Hours (build from scratch) | Days (training required) | ✅ Instant |

| Contract length | Month-to-month | Annual commitment | ✅ Cancel anytime |

| Mobile access | ❌ Desktop files | ❌ Desktop app | ✅ Any device |

| Custom branding | Manual | Limited | ✅ Logo & company name |

| Multi-tier debt | Manual | ✅ Supported | ✅ Senior + Mezz built-in |

| Value-add modeling | Manual formulas | Basic | ✅ Per-unit reno, rent bumps |

| Expense breakdown | Manual | ✅ Detailed | ✅ Tax, mgmt fee, reserves |

| Support | None | 💰 Paid extra | ✅ Included |

| Export options | Copy/paste | PDF only | ✅ PDF + Excel |

| Formula errors | ⚠️ Common risk | ✅ Low | ✅ Battle-tested |

| AI OM Parser | ❌ Manual entry | ❌ Manual entry | ✅ Upload PDF → Auto-fill |

| Market defaults | ❌ Research yourself | Limited | ✅ 20+ markets built-in |

| Quick calculators | Build your own | ❌ Not included | ✅ Per-unit, NOI→Price |

| Listing URL import | ❌ Copy/paste | ❌ Not available | ✅ Paste URL → Auto-fill |

Enter purchase price, rent roll, and financing terms. Takes 2 minutes.

One click runs cash flows, sensitivity, and Monte Carlo simulations.

Interactive dashboards show IRR, cash flows, and risk metrics.

Generate PDF reports with your branding for investors.

Watch how to underwrite a $5M multifamily deal from start to finish.

See how Pro Forma AI saves you more than it costs in months, not years.

| Cost Saved | How | Annual Savings |

|---|---|---|

| ⏰ Analyst Time | 4 hrs/deal → 15 minutes | $50K-100K/yr in salary |

| 📈 More Deals Closed | Analyze 5x more deals | 1 extra deal = massive fees |

| 🛡️ Bad Deals Avoided | Monte Carlo shows true risk | Avoid 1 bad deal = $500K+ saved |

| 💸 ARGUS Replaced | Replace $15K/seat software | $15K+ saved per seat |

"An $80K analyst + Pro Forma AI outperforms a team of 3. 10x the output at a fraction of the cost."

"Avoid just ONE bad deal and you've paid for a lifetime license 5x over."

"Close ONE extra deal per year because you analyzed faster — that's $5M+ in AUM. The software paid for itself 50x."

No hidden fees. Cancel anytime.

Perfect for solo investors

For serious investors

For institutional teams

Our simulations use industry-standard log-normal distributions. Each simulation runs a complete cash flow waterfall, not simplified approximations.

Yes! We support preferred returns, GP catch-up, and multi-tier promotes. The waterfall follows standard priority: ROC → Pref → Catch-up → Residual.

Multifamily, Office, Retail, Industrial, and Custom. Each has pre-configured defaults you can customize.

Yes. No long-term contracts. Cancel from your account settings at any time.

Download full model data as .xlsx for further analysis or sharing

Generate institutional-quality investment memos with your branding

All deals saved securely — access from any device, anywhere

Interactive visualizations you can embed or screenshot for presentations

We spent years building Excel models for real estate deals — and watching deals slip away because the analysis took too long.

Pro Forma AI was born from frustration. We wanted institutional-quality analysis without the institutional price tag. We wanted Monte Carlo simulations without a PhD in statistics. We wanted to move fast without sacrificing rigor.

Today, Pro Forma AI helps investors analyze deals 10x faster. Our users have underwritten billions in transactions — from small multifamily to large commercial portfolios.

Join investors who analyze deals 10x faster with Pro Forma AI.

Get Started →Have questions? We're here to help.

We typically respond within

24 hours